Raise the funds.

Manage the details.

Get business done.

Flexible + secure

Your next-level enterprise ecosystem.

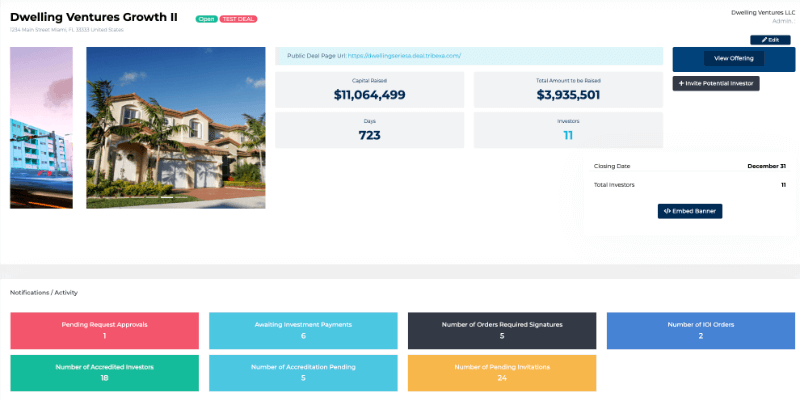

Tribexa manages the precision required when raising funds — from version-tracking all your marketing, to coordinating signatures, to working as your registered transfer agent. All without leaving your custom, secure platform.

But raising capital is the starting line, not the end point. Tribexa connects all of your stakeholders in a powerful enterprise ecosystem, enabling a better, more efficient, transparent and cost-effective way of working.

Deep continuity

From dashboard to data room.

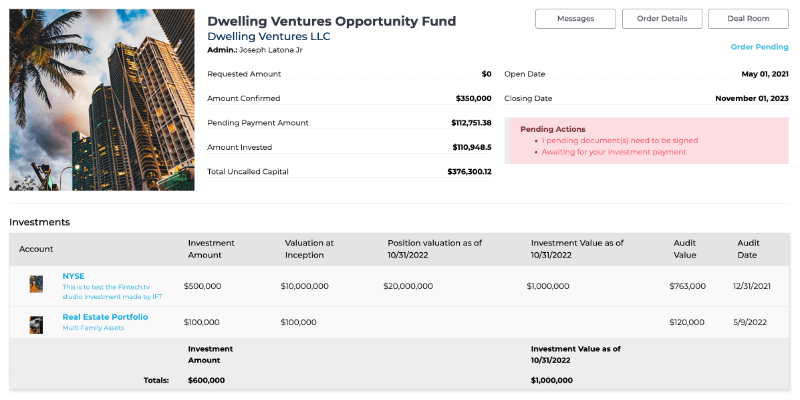

Whether sticking your toe in the private equity market, managing a billion dollar fund or simply working with investors on an ongoing basis, the details are critical and numerous. Tribexa simplifies and organizes these thousand touchpoints of daily business while tracking every last detail, keeping you compliant and secure. With APIs and easy, drag-and-drop input, we’ve made implementation with existing data and documents remarkably intuitive and fast.

More importantly, we let you get business done — signing contracts; engaging lawyers, advisors and accountants; capital calls; distribution; invoicing; transferring shares; assigning tasks; creating reports and accessing tax documents — all coordinated from your custom, white-labeled portal. It makes enterprise-critical functions effortless and integrated.

Intuitive + powerful

Complete enterprise insight.

Tribexa’s proprietary approach means every dashboard, report, capital call and data pull is accurate — and right at your fingertips. It’s built on robust permissioning that secures your data and logs all access.

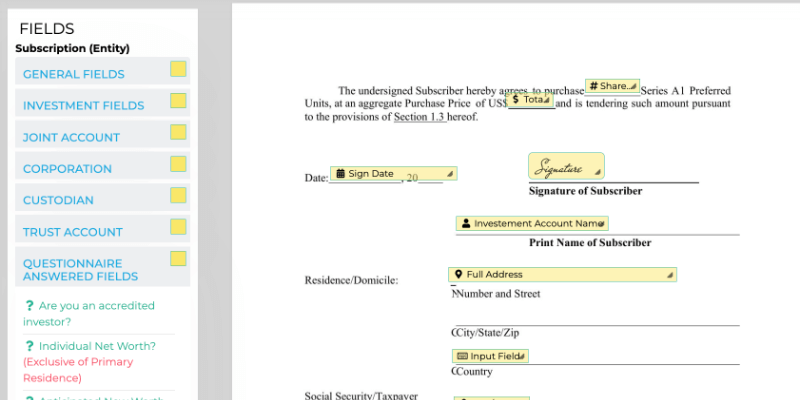

Powerful integrated e-sign system.

The difference with our e-sign system, X-ecute, is the ecosystem. When documents that are signed here stay here, every detail is trackable, accountable and manageable, whether you are a single entity, or you manage 2,000.

Registered transfer agent.

Our whole goal is to simplify the business of business. That’s why you have access to a built-in transfer agent, Tribexa Transfer, and governance and regulation is guaranteed from day one.

Using Tribexa, we can now support twice the number of clients with half the team. As a service provider, we’re now able to scale in a way we never could before. Tribexa has transformed our business.

Arthur Weissman

CEO, Industry Fintech

Features

Welcome to your personalized enterprise ecosystem.

Tribexa’s proprietary platform provides flexible, white-labeled, turnkey business ecosystem management:

Fundraising + capital management

- Deep fundraising capabilities, tracking versions and signatures with embedded CRM capability.

- Vesting of options, restricted stock, etc., with tracked up-to-date cap tables.

- Capitalization management with Tribexa Transfer, our SEC-registered transfer agent.

- Investor portal-embedded CRM with document generation and analysis capabilities.

- Compliance filing prompts and reminders.

Operations facilitation

- Intelligent governance workflows streamline approvals — with the ability to create your own unique approval workflows.

- Robust finance integration, including billing, escrow, money transfer, capital calls, distributions, API connectivity with your general ledger, major banks and brokerage firms.

- An endless range of corporate reports and data analysis.

- Sophisticated IR capabilities.

- Signing, tracking and storing key human resources documents.

Contract + document processes

- Our powerful e-sign system, X-ecute, pre-populates data entered by investors, employees, and others.

- Intuitive document repository with versioning and access management, and one-click audit document compiling.

- Endlessly customizable data rooms.

Communication + coordination

- Centralized messaging with cascading engagement flows.

- A company calendar that integrates and auto-notifies on contracts, e-signing and deliverables and other key objectives, centralizing your teams and tasks.

Customizable

Endlessly customizable

The power at the center of it all.

Tribexa is different because we place the enterprise in the epicenter. That means our wide constellation of foundational business services rotates around you and what you need to keep business humming. It means every round-closing, capital call, data room, report and investor record is born from a “single source of truth,” making the work accurate and efficient, regardless of the software you use or the portals with which you interface.